Table of Contents

Introduction – How to create Passive income streams

How to create Passive income streams – Are you tired of trading your time for money? 🕰️💰 Imagine waking up to find your bank account has grown while you slept. That’s the power of passive income – and it’s not just a dream, it’s a achievable reality.

In today’s fast-paced world, creating multiple streams of passive income isn’t just smart – it’s essential. Whether you’re looking to supplement your current salary, build long-term wealth, or achieve financial freedom, passive income can be your ticket to a more secure and flexible future. But where do you start? 🤔

From dividend stocks and real estate to digital products and affiliate marketing, the opportunities are vast and varied. In this comprehensive guide, we’ll explore ten proven strategies to help you create passive income streams that work for you. Get ready to unlock the secrets of financial growth and take control of your financial destiny! Let’s dive in and discover how you can start building your passive income empire today. 💼🚀

Understanding Passive Income

A. Definition and benefits

Passive income refers to earnings derived from ventures that require minimal ongoing effort to maintain. Unlike active income, which demands continuous work, passive income streams can provide financial stability and freedom. Benefits include:

- Financial security

- Time flexibility

- Scalability

- Diversified income sources

How to create Passive income streams

B. Differentiating passive from active income

To better understand passive income, let’s compare it with active income:

| Aspect | Passive Income | Active Income |

|---|---|---|

| Time investment | Initial setup, minimal ongoing effort | Continuous work required |

| Scalability | Easily scalable | Limited by time and energy |

| Risk | Can be higher initially | Generally lower, more stable |

| Income potential | Unlimited growth potential | Often capped by hourly rates or salary |

C. Setting realistic expectations

While passive income offers numerous advantages, it’s crucial to set realistic expectations:

- Initial time and effort investment

- Potential for slow start and gradual growth

- Need for patience and persistence

- Importance of diversification

Passive income streams often require significant upfront work and may not yield immediate results. However, with proper planning and execution, they can provide long-term financial benefits and increased flexibility in your lifestyle.

Investing in Dividend Stocks

Now that we understand the concept of passive income, let’s explore one of the most popular methods: investing in dividend stocks. This strategy can provide a steady stream of income while potentially growing your wealth over time.

How to create Passive income streams

Researching high-yield stocks

When looking for dividend stocks, focus on companies with:

- Consistent dividend payment history

- Strong financial health

- Sustainable payout ratios

Here’s a comparison of some high-yield sectors:

| Sector | Average Dividend Yield | Risk Level |

|---|---|---|

| Utilities | 3-5% | Low |

| REITs | 4-6% | Medium |

| Telecom | 4-7% | Medium |

| Energy | 5-8% | High |

Building a diversified portfolio

Diversification is key to managing risk. Consider:

- Spreading investments across different sectors

- Including both domestic and international stocks

- Balancing high-yield stocks with growth stocks

How to create Passive income streams

Reinvesting dividends for compound growth

Reinvesting dividends can significantly boost your returns over time:

- Automatically purchase more shares

- Take advantage of dollar-cost averaging

- Accelerate portfolio growth through compounding

By consistently reinvesting dividends, you can potentially double your investment returns over the long term. As we move forward, we’ll explore another passive income opportunity: real estate investments.

How to create Passive income streams

Real Estate Investment Opportunities

Real estate investment offers diverse opportunities for generating passive income. Let’s explore some popular options:

A. Rental Properties

Owning rental properties can provide a steady stream of income. Here are some key points to consider:

- Long-term tenants offer stable cash flow

- Potential for property value appreciation

- Tax benefits through deductions

How to create Passive income streams

B. Real Estate Investment Trusts (REITs)

REITs allow investors to participate in real estate without direct property ownership:

- Publicly traded on stock exchanges

- Typically offer higher dividends than stocks

- Provide portfolio diversification

C. House Flipping

House flipping involves purchasing, renovating, and reselling properties for profit:

- Potential for significant short-term gains

- Requires market knowledge and renovation skills

- Higher risk but potentially higher rewards

D. Short-term Rentals

Platforms like Airbnb have popularized short-term rentals:

- Higher potential income compared to long-term rentals

- Flexibility in property usage

- Requires more active management

How to create Passive income streams

| Strategy | Income Potential | Risk Level | Time Commitment |

|---|---|---|---|

| Rental Properties | Medium | Low-Medium | Low-Medium |

| REITs | Low-Medium | Low | Very Low |

| House Flipping | High | High | High |

| Short-term Rentals | Medium-High | Medium | Medium-High |

Each real estate investment strategy offers unique benefits and challenges. Consider your financial goals, risk tolerance, and available time when choosing the right approach for your passive income journey.

Creating Digital Products

In the digital age, creating and selling digital products has become a lucrative passive income stream. Let’s explore some popular options:

A. E-books and Online Courses

E-books and online courses offer a fantastic way to monetize your expertise. Here’s a comparison of these two formats:

| Feature | E-books | Online Courses |

|---|---|---|

| Format | Downloadable PDF or e-reader file | Video lessons, quizzes, and interactive content |

| Time Investment | Lower (one-time creation) | Higher (course development and potential updates) |

| Pricing | Generally lower ($5-$30) | Higher ($50-$500+) |

| Engagement | Self-paced reading | Interactive learning experience |

| Potential Reach | Wider (easier to consume) | More targeted (specific learning goals) |

B. Stock Photography and Graphics

Visual content is in high demand across various industries. Consider these options:

- Stock photos for websites and marketing materials

- Vector graphics and illustrations for designers

- Templates for presentations and social media posts

How to create Passive income streams

C. Music and Sound Effects

Audio content creators can tap into several markets:

- Royalty-free music for YouTube videos and podcasts

- Sound effects for video games and film production

- Jingles and background music for commercials

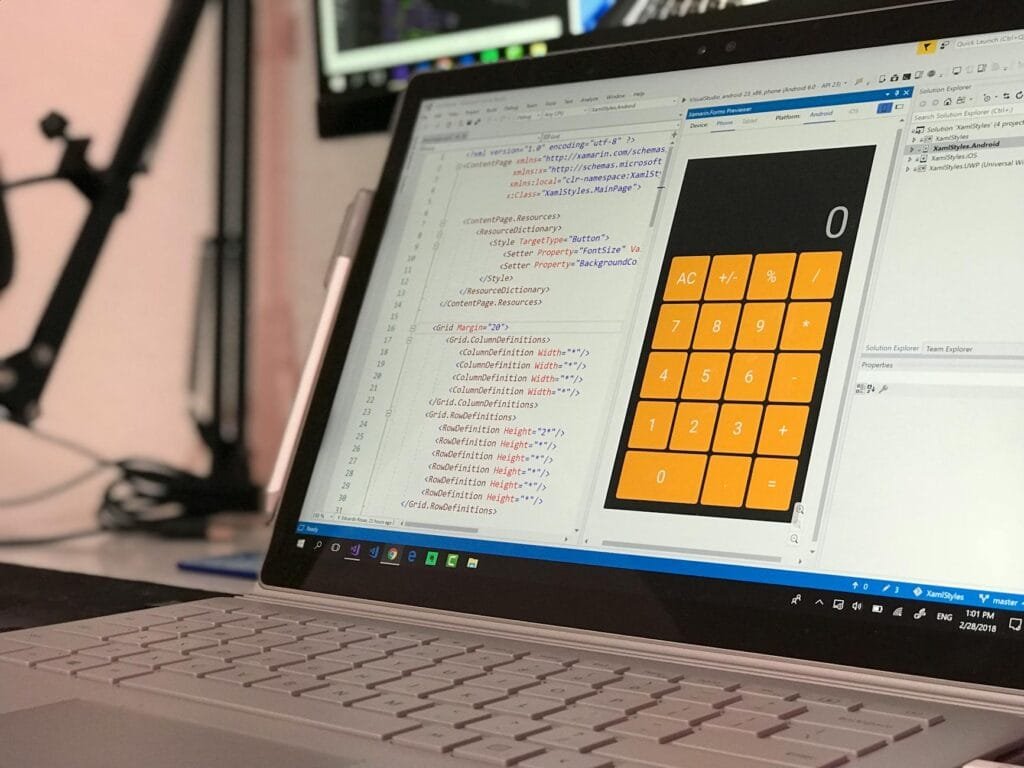

D. Software and Mobile Apps

Developing software or mobile apps can lead to substantial passive income. Some ideas include:

- Productivity tools

- Educational apps

- Entertainment and gaming applications

- Niche industry-specific software solutions

How to create Passive income streams

Now that we’ve explored digital product creation, let’s move on to another powerful passive income strategy: affiliate marketing.

Affiliate Marketing Strategies

Now that we’ve explored various passive income opportunities, let’s dive into affiliate marketing strategies, a powerful way to generate income by promoting other people’s products.

How to create Passive income streams

Choosing profitable niches

Selecting the right niche is crucial for affiliate marketing success. Consider these factors:

- Market demand

- Competition level

- Profit potential

- Your personal interests

| Niche Characteristic | Importance | Example |

|---|---|---|

| Market demand | High | Health and wellness |

| Competition level | Medium | Tech gadgets |

| Profit potential | High | Online courses |

| Personal interest | Medium | Travel gear |

Building a website or blog

A well-designed website or blog serves as your affiliate marketing hub. Key steps include:

- Choose a domain name and hosting provider

- Select a user-friendly content management system (e.g., WordPress)

- Implement a clean, responsive design

- Optimize for search engines

Creating valuable content

Quality content is the backbone of successful affiliate marketing. Focus on:

- Informative product reviews

- How-to guides and tutorials

- Comparison articles

- Expert roundups

How to create Passive income streams

Promoting products effectively

Employ these strategies to boost your affiliate marketing efforts:

- Use eye-catching visuals and banners

- Incorporate product links naturally within content

- Leverage email marketing to promote offers

- Engage with your audience on social media platforms

How to create Passive income streams

By implementing these affiliate marketing strategies, you’ll be well on your way to creating a sustainable passive income stream. Next, we’ll explore the world of peer-to-peer lending and how it can diversify your income portfolio.

Peer-to-Peer Lending

Now that we’ve explored various passive income opportunities, let’s delve into peer-to-peer lending, an innovative way to generate returns on your investments.

How to create Passive income streams

Understanding the Risks and Rewards

Peer-to-peer lending offers potential high returns but comes with inherent risks:

| Rewards | Risks |

|---|---|

| Higher interest rates | Borrower defaults |

| Portfolio diversification | Platform failures |

| Monthly cash flow | Lack of FDIC insurance |

| Low correlation with stock market | Regulatory changes |

Selecting a Reliable Platform

Choosing the right platform is crucial for success in peer-to-peer lending:

- Research platform history and reputation

- Check interest rates and fee structures

- Evaluate loan approval processes

- Assess available loan types and terms

- Review investor protection measures

Diversifying Your Loan Portfolio

Diversification is key to mitigating risks in peer-to-peer lending:

- Spread investments across multiple loans

- Invest in different loan grades (A to E)

- Allocate funds to various loan purposes (personal, business, etc.)

- Consider geographical diversification

- Use automated investing tools for efficient allocation

How to create Passive income streams

By carefully considering these aspects of peer-to-peer lending, you can potentially create a steady stream of passive income while managing associated risks. Next, we’ll explore another exciting avenue for passive income: launching a YouTube channel.

Launching a YouTube Channel

Now that we’ve explored various passive income strategies, let’s dive into the exciting world of YouTube content creation. Launching a successful YouTube channel can be an excellent way to generate passive income while sharing your passion with the world.

How to create Passive income streams

A. Identifying your niche and target audience

To stand out in the crowded YouTube landscape, it’s crucial to:

- Choose a specific niche that aligns with your expertise and interests

- Research your target audience’s preferences and pain points

- Analyze successful channels in your niche for inspiration

How to create Passive income streams

B. Creating engaging content consistently

Consistency is key to growing your YouTube channel. Consider the following:

- Develop a content calendar

- Invest in quality equipment (camera, microphone, lighting)

- Learn basic video editing skills

- Optimize your video titles, descriptions, and tags for SEO

How to create Passive income streams

C. Monetizing through ads and sponsorships

Once your channel grows, you can start earning through:

| Monetization Method | Description |

|---|---|

| AdSense | Earn money from ads displayed on your videos |

| Sponsorships | Partner with brands for paid promotions |

| Channel Memberships | Offer exclusive perks to paying subscribers |

D. Leveraging affiliate marketing

Incorporate affiliate marketing into your YouTube strategy by:

- Recommending products related to your niche

- Including affiliate links in your video descriptions

- Creating honest and helpful product reviews

How to create Passive income streams

As your YouTube channel grows, you’ll find that it can become a significant source of passive income. Next, we’ll explore another exciting avenue for generating passive income: developing a mobile app.

Developing a Mobile App

Now that we’ve explored various passive income streams, let’s dive into the exciting world of mobile app development. Creating a successful app can be a lucrative venture, providing a steady stream of passive income.

How to create Passive income streams

A. Identifying a market need

Before diving into development, it’s crucial to identify a gap in the market. Consider the following steps:

- Research existing apps

- Analyze user reviews and ratings

- Conduct surveys or focus groups

- Stay updated on industry trends

How to create Passive income streams

B. Designing user-friendly interfaces

A well-designed interface can make or break your app’s success. Keep these principles in mind:

- Intuitive navigation

- Consistent design elements

- Responsive layouts

- Accessibility features

How to create Passive income streams

C. Monetization strategies

There are several ways to generate income from your app:

| Strategy | Description |

|---|---|

| In-app purchases | Offer premium features or content |

| Subscription model | Charge recurring fees for access |

| Freemium | Basic version free, charge for advanced features |

| Advertising | Display ads within the app |

D. Marketing and promoting your app

To ensure your app reaches its target audience:

- Optimize app store listings

- Leverage social media platforms

- Collaborate with influencers

- Implement app store optimization (ASO) techniques

How to create Passive income streams

With a well-executed mobile app, you can create a passive income stream that continues to generate revenue long after the initial development phase.

Licensing and Royalties

Licensing and royalties offer a powerful avenue for generating passive income through intellectual property. By creating valuable assets and granting others the right to use them, you can earn ongoing revenue with minimal effort.

How to create Passive income streams

Creating Patentable Inventions

Developing innovative solutions to existing problems can lead to lucrative patent opportunities. Consider these steps:

- Identify market needs

- Research existing patents

- Develop unique solutions

- File for patent protection

- License your invention to manufacturers

Writing Books or Music

Creative works can generate royalties for years after their initial release. Here’s how to maximize your earnings:

- Choose a popular genre or niche

- Create high-quality content

- Publish through traditional or self-publishing channels

- Market your work effectively

- Explore licensing opportunities for adaptations

Developing Trademarks

Building recognizable brands can lead to valuable licensing agreements. Follow these strategies:

- Create a unique brand identity

- Register your trademark

- Build brand recognition

- Seek licensing partnerships

- Negotiate favorable royalty rates

| Asset Type | Potential Income | Time Investment | Skill Level Required |

|---|---|---|---|

| Patents | High | High | Expert |

| Books/Music | Medium to High | Medium | Intermediate to Expert |

| Trademarks | Medium to High | Low to Medium | Beginner to Intermediate |

By diversifying your intellectual property portfolio across these areas, you can create multiple streams of passive income through licensing and royalties. Remember to protect your assets legally and negotiate favorable terms to maximize your earnings potential.

Building an E-commerce Store

Now that we’ve explored various passive income opportunities, let’s dive into building an e-commerce store, a powerful way to generate ongoing revenue.

Choosing a profitable niche

Selecting the right niche is crucial for e-commerce success. Consider these factors:

- Market demand

- Competition level

- Profit margins

- Your personal interests

Sourcing products

Once you’ve chosen your niche, it’s time to find products to sell. Here are some options:

- Wholesale suppliers

- Manufacturers

- Alibaba or AliExpress

- Local artisans or craftspeople

Setting up dropshipping

Dropshipping is a popular fulfillment method that can reduce upfront costs and inventory management. Here’s a comparison of traditional retail vs. dropshipping:

| Aspect | Traditional Retail | Dropshipping |

|---|---|---|

| Inventory | Store and manage | No inventory |

| Upfront costs | Higher | Lower |

| Profit margins | Higher | Lower |

| Shipping | Handle yourself | Supplier handles |

Implementing effective marketing strategies

To drive traffic and sales, consider these marketing tactics:

- Search engine optimization (SEO)

- Social media marketing

- Email marketing

- Pay-per-click advertising

Automating operations

Automation is key to making your e-commerce store a truly passive income source. Use tools to automate:

- Order processing

- Customer service

- Inventory management

- Marketing campaigns

By following these steps, you can build a successful e-commerce store that generates passive income while you focus on growing your business or pursuing other ventures.

Conclusion – How to create Passive income streams

Passive income streams offer a powerful way to build wealth and achieve financial freedom. By exploring diverse opportunities such as dividend stocks, real estate investments, digital products, affiliate marketing, and peer-to-peer lending, you can create multiple sources of income that work for you around the clock. The key is to start small, diversify your efforts, and continuously learn and adapt your strategies.

Remember, building passive income takes time, effort, and often an initial investment. However, the long-term benefits of financial stability and increased flexibility in your lifestyle make it a worthwhile pursuit. Choose the methods that align with your skills, interests, and resources, and take consistent action towards your goals. With persistence and smart planning, you can create a robust portfolio of passive income streams that will support your financial future for years to come.

Powered By Google AI

Related Keywords –

- how to create multiple passive income streams

- how to create a passive income stream

- how to create passive income streams

- how to create passive streams of income

- how to create multiple streams of passive income

- how to create passive income streams online

- how to create streams of passive income

- create a passive income stream

- create passive income streams

- creating a passive income stream

- creating passive income streams

- how to create multiple passive income streams

- how to create a passive income stream

- how to create passive income streams

- how to create passive streams of income

- creating multiple passive income streams

- creating multiple streams of passive income

- creating streams of passive income

- how to create multiple streams of passive income

- how to create passive income streams online

- how to create streams of passive income

- ways to create passive income streams

Frequently Asked Questions (FAQ’s) About How to create Passive income streams

How much can I realistically earn from passive income streams per month?

Beginners often start with $100–$500 monthly within their first year; experienced investors and creators can scale to $1,000–$5,000+ per month by diversifying across multiple streams. How to create Passive income streams.

What are the biggest risks when building passive income streams?

Key risks include market volatility (stocks/REITs), tenant vacancies (real estate), platform changes (affiliate programs), and upfront time investment. Mitigate these by diversifying and setting realistic goals.

Which passive income streams require the least maintenance?

REITs, high-yield savings accounts, and fully automated digital products (like evergreen online courses) typically demand the least ongoing upkeep once they’re established.

Can beginners create passive income streams while working a full-time job?

Absolutely. Start small with side hustles like stock dividend reinvestment or freelance content that can be repurposed as digital products, then scale as you free up time. How to create Passive income streams.

What tools and platforms help automate passive income streams in 2025?

Look into robo-advisors (for investing), autopilot email marketing (for digital products), AI-powered SEO tools (for affiliate blogs), and managed property services (for rentals) to streamline your income empire.

What exactly are passive income streams and how do they work?

Passive income streams are revenue sources that require minimal ongoing effort once set up—think dividend stocks, rental properties, or digital products—allowing you to earn money around the clock.

How can I create passive income streams with little to no upfront capital?

Start with low-cost options like affiliate marketing, print-on-demand, or publishing an e-book on Amazon. Over time, reinvest your earnings into higher-yield streams like real estate or dividend portfolios. How to create Passive income streams.

Which passive income streams are most profitable in 2025?

In 2025, high-yield dividend stocks, REITs, niche online courses, and automated e-commerce (dropshipping) rank among the top passive income sources thanks to low barriers to entry and strong market demand.

How long does it take to see returns when you create passive income streams?

Timelines vary widely: digital products and affiliate marketing can start generating income in 1–3 months, while dividend investing or real estate rentals often take 6–12 months to produce meaningful cash flow.

What are the tax implications of passive income streams in the US?

Passive income is generally taxed as ordinary income or qualified dividends. Rental income and REIT dividends may have special deductions (like depreciation), so consult a CPA to optimize your 2025 tax strategy.

Pingback: How To Make Money From Home Online For Beginners : 10 Easy Ways - PassiveProfit.in

Pingback: Powerful Ways To Boost Your Business With AI Marketing Content Creation In 2025🚀 - PassiveProfit.in

Pingback: Ultimate Instagram Caption Generator : Boost Your Instagram With AI Caption Generator 2025 - SuperWebTools

Pingback: Crafting Income on Etsy A Step-by-Step Guide to Earning Without Investment 2025 - Passive Profit

Pingback: Unlock Success: Perplexity AI 101 for Beginners Start Strong Today 🤖 - SuperWebTools